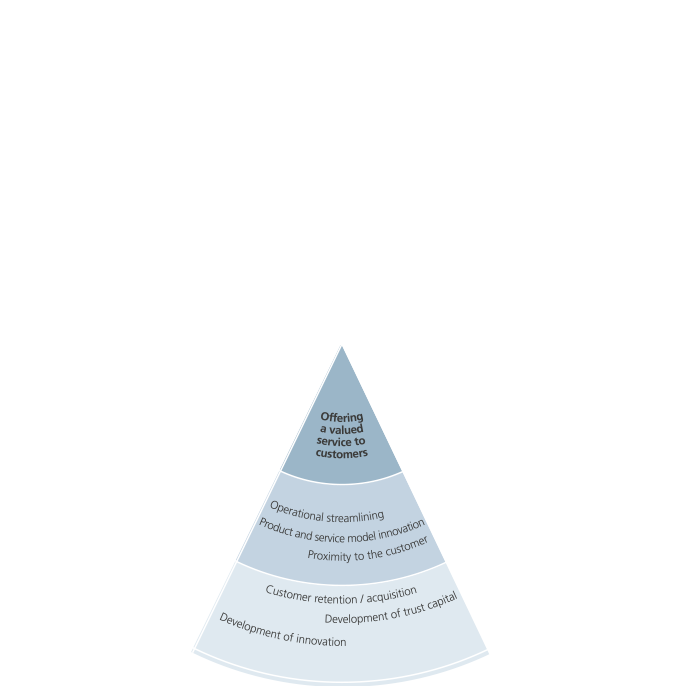

Why this issue is significant

To contribute to the wellbeing and progress of the community where it operates, Intesa Sanpaolo strives to provide an outstanding, reliable service, guaranteeing diversified support for different customer categories and promoting customer relations, through in-depth, systematic engagement, customer satisfaction surveys and an effective claims management process. This approach meets customers' needs for trust and proximity and paves the way for an overall growth strategy.

The service models adopted focus on customer needs and the business approach is geared towards advisory services that promote informed purchases. Special attention is paid to people with disabilities, to ensure full access to services.

The Group operates with a truly multichannel model to make banking services increasingly available, in a simple, efficient, flexible manner and at lower cost, providing multiple virtual contact points and greater accessibility of services. Intesa Sanpaolo promotes innovation and research and analyses innovative solutions available on the domestic and international markets to identify opportunities for growth, also through partnerships with universities and research centres.

Customer relations, customer satisfaction, claims, multichannel services and innovation are all monitored through internal regulations and operating procedures that comply with applicable laws, and also through dedicated processes and specific service models. Results are tracked and assessed over time during improvement processes.

The marketing functions of Business Units define the commercial model for customer relations and methods for analysing satisfaction, managing claims and developing new initiatives. Head Office Sub-Departments assist Business Units’ for areas in their responsibility.

In particular, the Savings Working Group of the Banca dei Territori Division, chaired by the Division Manager, is a technical body, with an advisory and decision-making role, dealing with asset management issues for retail and business customers.

Innovation is overseen by the Chief Innovation Officer department, which defines strategies and guidelines and identifies development opportunities for the Group and its customers.

The Business Plan puts customers at the very centre of the new service model. The branch model, offering open flexible places, has been extended to include advisory services with digital channels to make customers feel “at home”. The “Insieme per la Crescita” (Together for Growth) programme, focussing on relational and behavioural skills, has improved customer and people satisfaction, through service quality and a new branch experience. This change was measured by customer and employee satisfaction, using the branch barometer (a synthetic rating of 7.7 on a scale from 1 to 10, with over 230,000 questionnaires collected).

The contract digitalisation project, which reached the target of using only electronic or digital signatures, helped improve customer satisfaction; waiting times were decreased, filing was streamlined, cost savings achieved and the environmental footprint was reduced.

Better conditions to access services were achieved with the Online Branch and development of a multichannel approach (6.4 million customers, up by around 1.6 million since the start of 2014). International banks (above all Alexbank, CIB Bank and Privredna Banka Zagreb) developed a cutting-edge platform to access services through digital and physical channels (Digical).

Customer experience surveys were revised, to include the “SEIok Excellence System” in new indicators, which measures the service quality provided by branches for an easier identification of areas for improvement.

To support competitiveness, expertise and innovation in business, the Group provided training for SMEs (extending the “Skills4Business” programme with the introduction of “Digital4Export” on digitalisation and internationalisation), and implemented technological services (advisory services for sectors/technologies of excellence, support for new local economy projects and for start-ups with a considerable potential for growth, digital platforms for contact between “innovation creators” and potential users).

Performance indicators and objectives achieved

| Indicator | 2016 Results | 2017 Objectives |

|---|---|---|

| Insieme per la crescita | Approximately 4,000 branches involved Branch barometer: synthetic rating of 7.7 Over 220,000 questionnaires |

Customer and employee satisfaction and performance improvement |

| Systematic identification of the Net Promoter Score through web and telephone surveys | Approximately 400,000 ratings from retail and personal customers and 50,000 ratings from business customers NPS Retail: 8 NPS Businesses: 18 Surveys started in 2016 |

Developing Customer Experience Leadership through: - insight collected from NPS surveys in the Bank's operating and commercial processes; - initiatives to consolidate relations with requesting customers |

| Systematic Customer Experience surveys | Email and text message alerts to retail and businesses customers on the sale of products, advisory services and cash transactions. A target of approximately 2 million customers and around 250,000 ratings given Net satisfaction index: 45 (41 in 2015) |

Measuring satisfaction perceived by customers for all customer/bank points of contact and channels (branch, online, telephone and chat) and improving customer experience |

| Maintenance of the average response times to customer complaints and claims (parent company) in line with reference regulations (RR) | Investment activities Claims: 41 days (versus RR 90 days; 46 days in 2015) Appeals: 39 days Banking and financial services Claims: 19 days (versus RR 30 days; 19 days in 2015) Appeals: 18 days |

Keeping performance indexes high when listening to customers |

| Digitalisation of contracts | The target of eliminating hard copy signatures at all Retail and Personal branches was reached Approximately 8.3 m dematerialised transactions in 2016 |

Reducing waiting times, streamlining processes and improving service quality |

| Integrated multichannel development* | 6.4 m multichannel customers (+1.6 m from the start of 2014) |

7.9 m multichannel customers |

* In Italy, natural persons and legal entities (not including Fideuram Intesa Sanpaolo Private Banking).