Why this issue is significant

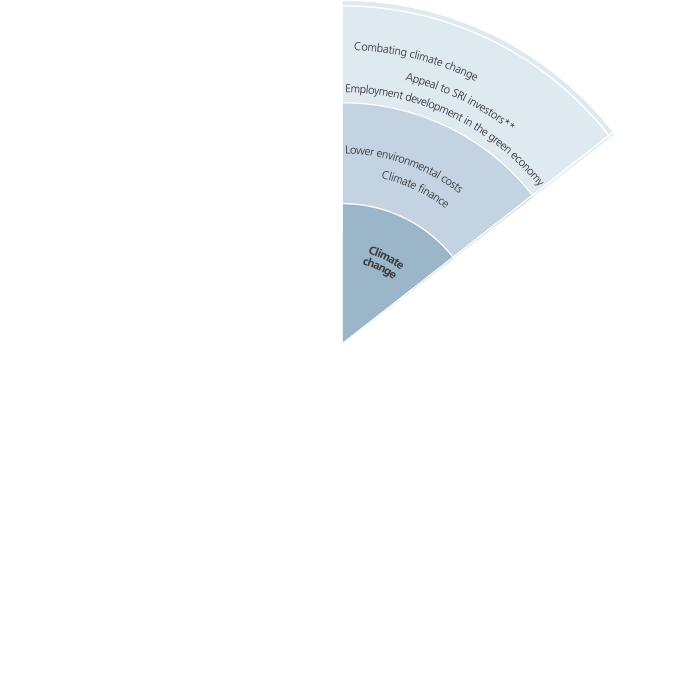

Climate change is far reaching, with consequences that not only affect the “environment”, but can have considerable repercussions on social dynamics and on future generations. It is worldwide in scope and rapidly evolving, involving all components of the environment, society and all aspects of the economic system, with considerable impact on customers, households, the community and consequently on the overall operations of the Group.

Intesa Sanpaolo, aware that the fight against climate change calls for a clear, effective strategy, has adopted an Environmental and Energy Policy which mainly focuses on reducing its ecological footprint and protecting the ecosystem, supporting research and innovation for improving energy performance, analysing risks and climate change opportunities, in order to incorporate them in company policies. In this context, the Group pursues qualitative and quantitative improvement objectives, to help offset the effects of climate change at both a social/environmental and business level. In particular, Intesa Sanpaolo has produced a Long Term Action Plan for Environmental Sustainability since 2009, for its long term objectives, in order to reduce risks and environmental impact and also decrease energy use and climate-altering emissions.

Through green finance activities and the development of innovative products and services, Intesa Sanpaolo supports its customers in reducing their ecological footprint and responding effectively to the pressure of environmental challenges.

Fighting climate change is a commitment to environmental sustainability set out in the Code of Ethics. Environmental and energy policy rules and specific policies originating from these establish standards and behaviour to adopt to focus on climate change. The scope refers to both direct impact on the environment deriving from the Bank's operations, for which a certified Environmental Management System has been adopted and Energy Manager and Mobility Manager positions established, and indirect impact deriving from customers and suppliers. The Intesa Sanpaolo Group carefully monitors risks relating to climate change to promote a behaviour that helps reduce and develop a culture focussed on prevention. The monitoring of these risks is based on processes in the Code of Ethics, the Environmental Management System and Sustainability Report that make it possible to identify objectives and action plans for the management and mitigation of these risks.

The CSR Sub-Department monitors the Group's social and environmental responsibility areas, planning, managing and monitoring sustainability policies and tools. This function reports, through the Chief Governance Officer, to the Managing Director and CEO and to the Board of Directors and works with a network of contacts at various entities of the Group in Italy and abroad. The Safety and Protection Department, reporting to the Managing Director and CEO, is responsible for governing the Environmental and Energy Management System adopted by the Group, monitoring direct and indirect impact and promoting improvement objectives, guaranteeing that international ISO certification is maintained in conjunction with relevant entities.

Intesa Sanpaolo is committed to environmental sustainability, also through green products and services.

In this context, the Group continued to provide financing in the field of renewable energy, energy savings and environmental protection, with measures for individual customers, enterprises and the Third sector.

Loans for over 1.7 billion euro were disbursed in 2016.

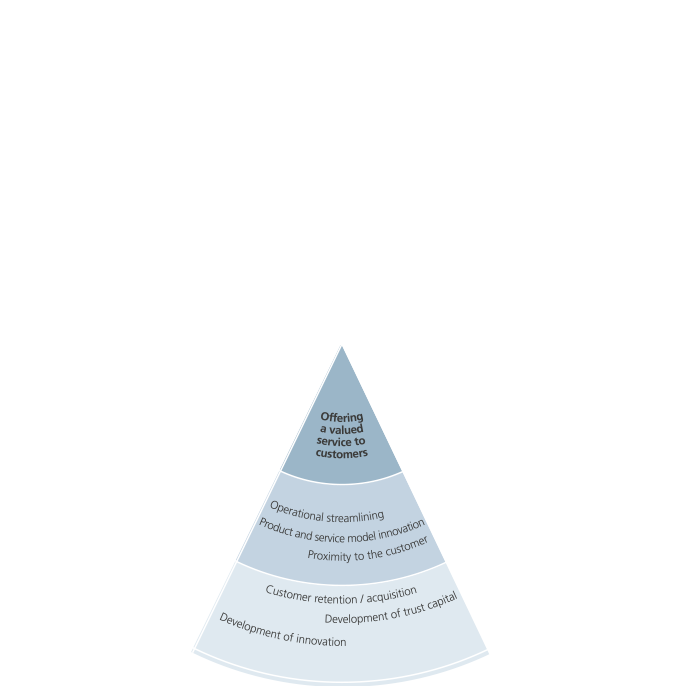

As for customer advisory services, Mediocredito Italiano's Energy Desk continued its specialist activities to analyse projects in the renewable energies sector, supporting the Group's commercial network.

Support for investments in research and technological innovation to tackle climate change was also considerable. The Intesa Sanpaolo Start-Up Initiative Programme continued to promote business initiatives with a high technological content, with a particular focus on the Clean Tech sector and Circular Economy.

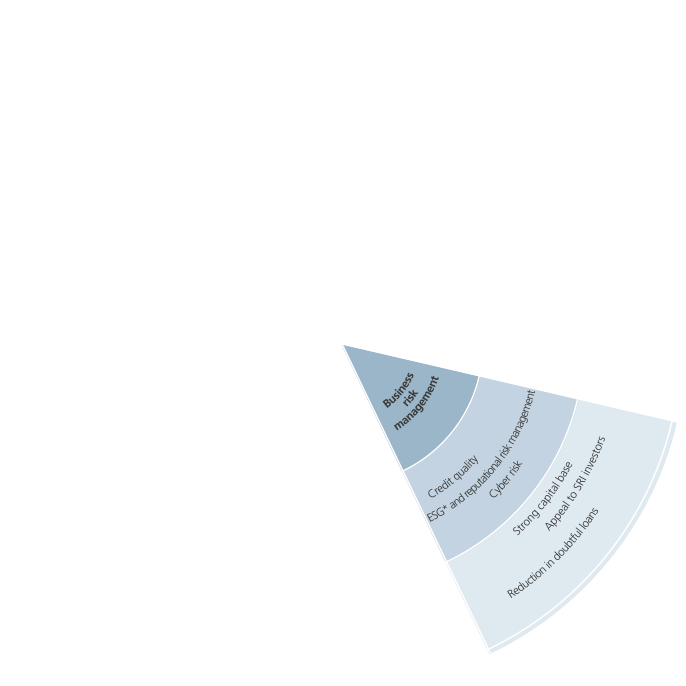

Environmental risk assessment in the loan process is ensured by Equator Principles screening and internal credit rating (see the section “Management of business risk” @).

As regards the management of direct impact on the environment, action continued to improve overall energy efficiency and reduce CO2 emissions. In Italy, around 97% of electricity used came from renewable sources, certified by a Guarantee of Origin, and with over 1,000 MWh produced from the Group's own photovoltaic plants. Thanks to feed-in tariffs and the fact that no electricity was bought, the photovoltaic plants at Moncalieri, Settimo Torinese and Sarmeola di Rubano generated savings of around 298,000 euro.

The Environment and Energy Management System, certified to ISO 14001 and ISO 50001 and, for the reporting of greenhouse gas emissions, to ISO 14064, continued to be extended in Italy. With the inclusion of the New Headquarters in Turin, the System is now in place at more than 200 operating units. In 2016, the Hungarian Bank CIB Bank was awarded ISO 50001 certification for all 85 sites.

The reduction in the Group's electricity and heating use, equal to 6.7%, generated an estimated economic return of over 800,000 euro and tax relief of around one million euro.

For sustainable mobility, the number of agreements with public transport companies, and car and bike sharing services, was increased.

89% of all paper purchased was eco-friendly paper. Dematerialisation programmes made it possible to avoid using around 2,700 tonnes of paper, with fewer CO2 emissions of over 4,300 tonnes and savings of around 3 million euro.

Awareness of environmental issues was developed internally, with training courses (a new course on waste management in Intesa Sanpaolo branches on the e-learning platform “Ambientiamo”), and externally, with customer notices and participation in numerous national and international events.

Performance indicators and objectives achieved

| Indicators | 2016 Results | 2016 Objectives | 2017 Objectives |

|---|---|---|---|

| Electricity consumption in Italy compared to 2012 | 19.9% reduction | 17% reduction | 20% reduction |

| Purchase of eco-friendly or recycled paper in Italy | 93% | 98% | 98% |

| Group indirect emissions (Scope2 – location based) compared to 2012 | 13.5% reduction | 13% reduction | 14% reduction |

| Extension of “other indirect emissions” reporting (Scope3) | The reporting scope of Internet banking transactions was extended to include international banks | Gradual expansion of the scope and improvement in reporting | |

| Environmental certification | The New Turin Headquarters (approximately 2,000 people) was included in the sample and CIB Bank (Hungary) was awarded ISO 50001 certification | The number of sites with UNI EN ISO 14001, UNI CEI EN ISO 50001 and UNI EN ISO 14064 certification was extended | The system was extended to another 25 operating units in Sicily, Tuscany, Umbria and Emilia and aligned with the new ISO 14001:2015 standard |