Why this issue is significant

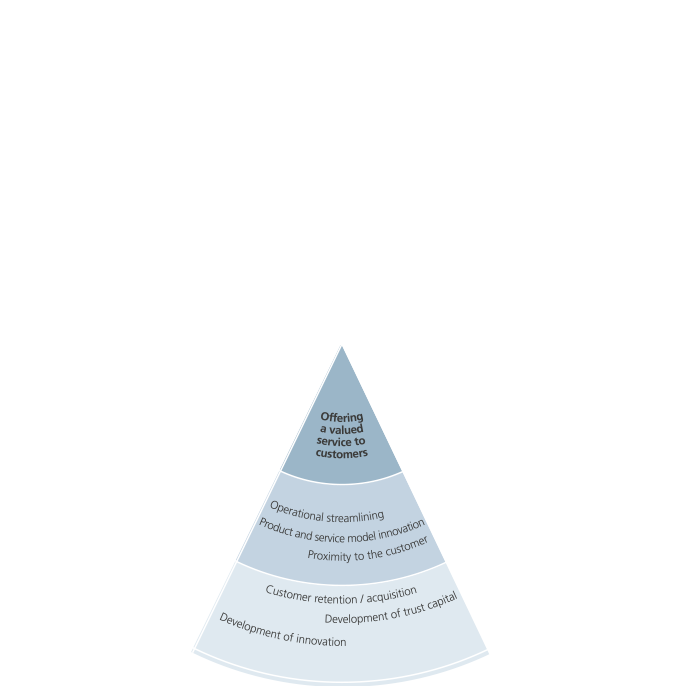

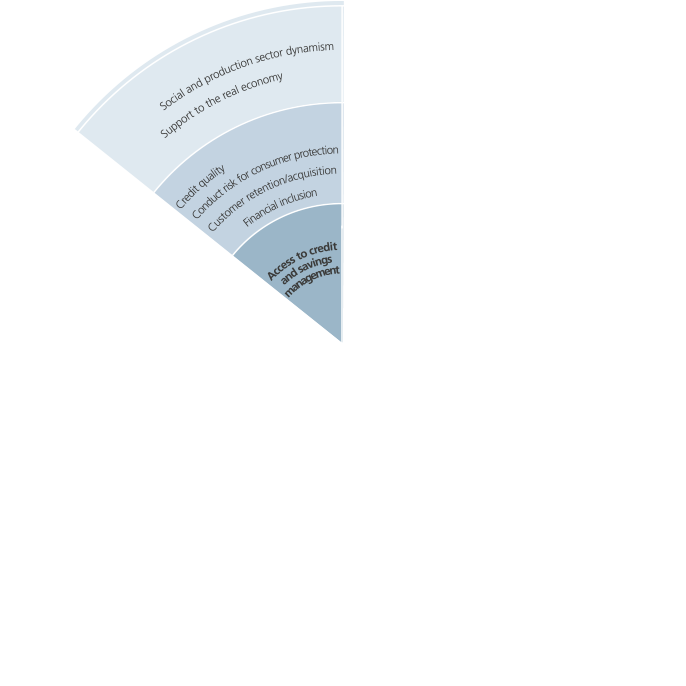

The Intesa Sanpaolo Group guarantees products and services that promote financial inclusion and access to credit. The correct allocation of resources and ability to identify local players with whom agreements and synergies can be developed facilitates inclusion, also for vulnerable people, preferring counterparties that meet requirements in terms of repayment capacity.

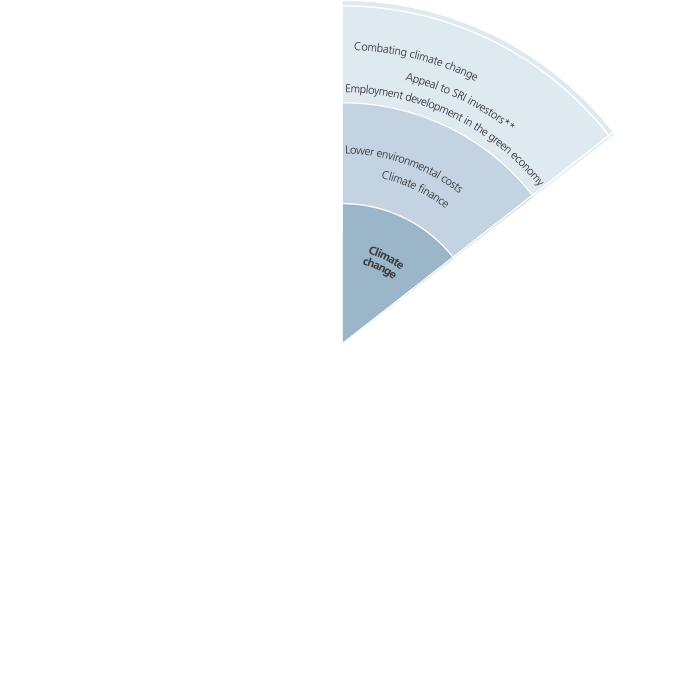

Asset management is also targeted by innovation, with the development of customer services offering investment as well as forms of protection and welfare – which are an increasingly important factor for the long term wellbeing of households. Intesa Sanpaolo's portfolios include funds which adopt selection criteria based on Principles for Responsible Investment, also with a view to generating sustainability dynamics in businesses and customer choices.

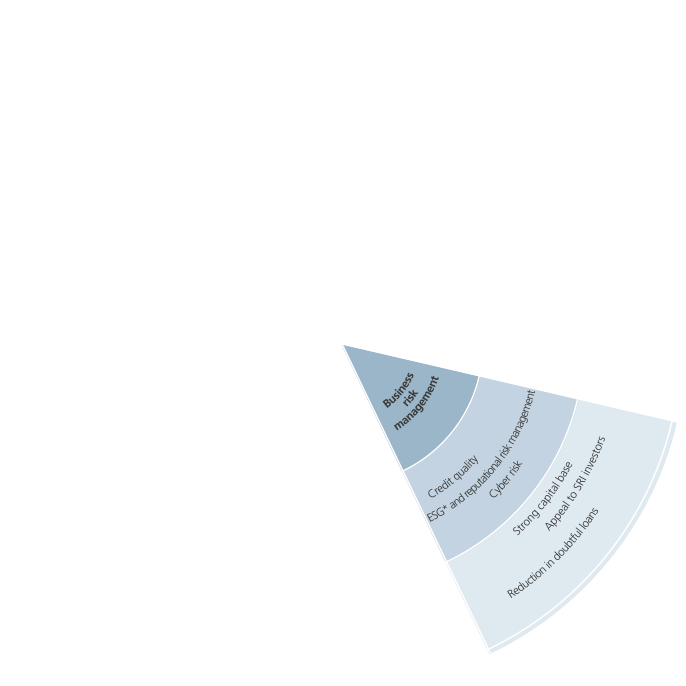

Intesa Sanpaolo acts on an ongoing basis to continually develop processes, rules and tools to manage credit using rating systems integrated with quality and forward-looking aspects and a proactive approach to preventing non-performing loans.

Intesa Sanpaolo steers, governs and supports the Group in coordinated action, based on Powers, Rules for Concession and Management and detailed Operating Procedures . With regard to Third sector customers, a rating model has been developed that is better suited to the characteristics of this type of customers.

Clear and specific positive and negative selection criteria are adopted for ethical investment funds, for securities to be included in the portfolio, with the supervision of an external, independent Sustainability Committee.

Risk management and control are monitored by corporate bodies, and coordinated by the Chief Risk Officer (for risk management) and by the Chief Lending Officer (for Group credit risk and management), reporting directly to the Chief Executive Officer.

These areas of central responsibility support Business entities and other functions involved in the credit process, with the aim of making credit disbursement, management and control more efficient and effective.

As for asset management, “Group Product Governance Guidelines on financial and banking products for retail customers” have been defined, updating the legal and organisational framework for a fully comprehensive and unique approach to rules on customer relations and the conduct to adopt for retail proposals.

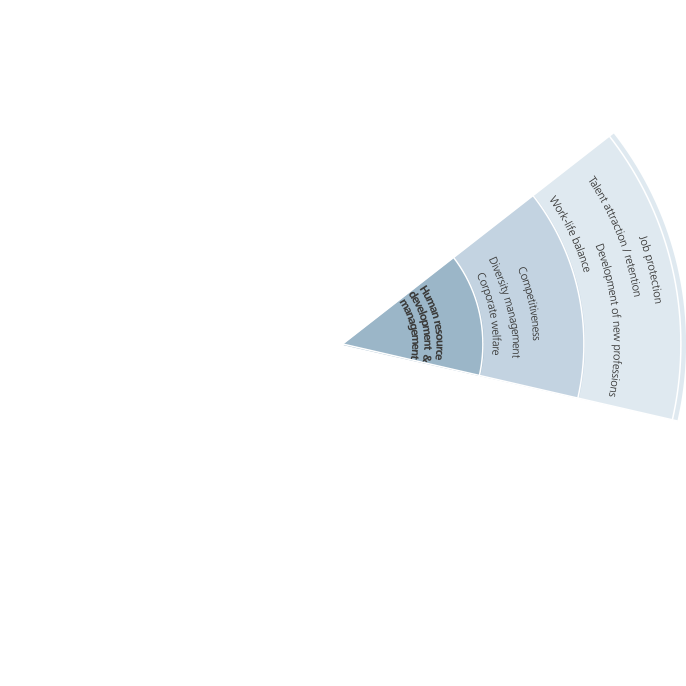

The key objective of the Business Plan is to develop the real economy and communities where the Group operates. Actions to promote access to credit continued, with initiatives to offer micro-credit and combat usury, totalling around 76 million euro. Various solutions for young people and households were offered, including “Mutuo Giovani”, a mortgage with special conditions for first home buyers and “Per Te Prestito con Lode”, loans and agreements to support university students. To protect economic stability and safeguard people and households in difficult situations, several insurance solutions were made available (the “ProteggiMutuo”, “Mi curo dei miei”, “Tu dopo di Noi”, “Offerta Salute” policies for mortgage protection, life and health insurance).

To support the business system, the “Entrepreneurship Micro-Credit Loan” was launched for small businesses, which does not require collateral and uses a special part of the Guarantee Fund for SMEs of the Ministry for Economic Development. The “Production Chain Development” programme improves credit access conditions for investments in industrial production chains with a new risk assessment that takes into account quality aspects. Partnerships with trade associations (Confindustria Piccola Industria, Confindustria, Confcommercio, Confagricoltura, and Coldiretti) promoted investments in fixed and intangible capital, above all in research, innovation and training.

Support for the start-up of Italian businesses (Intesa Sanpaolo Start-Up Initiative to promote new companies with a high technological content) and companies investing in innovation and research (“Nova+” programme) was considerable.

To promote the growth of large companies and Groups on international markets, the Corporate and Investment Banking Division put in place an extensive reorganisation process to include advisory services and specialist, focussed products (Transaction Banking, with specific reference to support for Cash Management and Trade Finance) as part of international network assistance (available in over 40 countries).

Activities to support the Third sector and social economy continued with new medium and long term loans in support of social enterprises for approximately 200 million euro. In November 2016, Banca Prossima was awarded Certified Benefit Corporation (B-Corp) certification, demonstrating the benefits it has generated for the community.

As regards asset management and sustainable investment products, Eurizon Capital and Banca Fideuram offer socially responsible investment solutions. In particular, Eurizon Capital has developed asset management products in line with Principles for Responsible Italian Stewardship Principles for exercising administrative and voting rights in listed companies it has invested in.

Performance indicators and objectives achieved

| Indicators | 2016 Results | 2017 Objectives cumulative value 2014-2017 |

|---|---|---|

| New medium/long term credit granted to the real economy | 56 bn in 2016 137 bn cumulative figure 2014-2016 |

Approximately 170 bn |

| New medium/long term credit granted to social enterprises | 0.2 bn in 2016 0.6 bn cumulative figure 2014-2016 |

Approximately 1.2 bn |

| Loans for initiatives with a high social impact | 4.6 bn in 2016 More than 11.4 bn cumulative figure 2014-2016 |

Support for vulnerable social groups |

| Nova+ loans for business innovation | 46.5 m in 2016 More than 245 m cumulative figure 2014-2016 |

Support for companies that create innovation |