Why this issue is significant

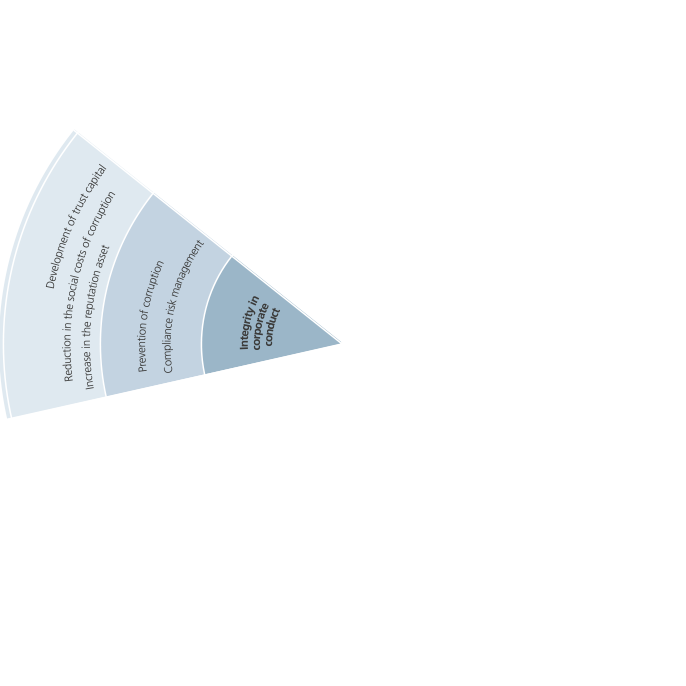

The Intesa Sanpaolo Group recognises the strategic importance of activities to ensure compliance with internal and external regulations and codes of conduct, in the belief that respecting standards and fairness in business are essential elements in carrying out banking operations, which by nature are based on trust. The view is that compliance with standards encourages the creation and maintenance of a competitive economic context, in which merit can be promoted and shared value can be created, contributing to the area and community development. Intesa Sanpaolo aims to be a reliable, qualified contact for regulators, dealing with them in a transparent manner and helping to develop the regulatory context through the identification of common objectives for banks and stakeholders. The Group actively supports the United Nations’ Global Compact principles that envisage the development of activities to combat corruption, protect human rights and respect the environment.

The Group also focuses in particular on developments in international tax legislation steered by the OECD to offset tax evasion and the transfer of profits from high-taxation to low-taxation countries, with a steadfast commitment to adopting the principles.

Intesa Sanpaolo complies with rules through all company members/areas – corporate bodies, company control functions and operating and business functions – working together, based on principles and standards of conduct which are set out in governance documents and incorporated in the Bank's operating procedures, and that are observed by all employees. Specific provisions are issued for more sensitive areas (anti-money laundering, anti-corruption, taxation, anti-trust, privacy, fairness in customer relations, etc.).

Training is provided on internal regulations and operating procedures to familiarise Bank personnel. The regulations and procedures are revised on a regular basis to align them with company operations and legal developments and are periodically verified by control functions to ensure they are actually complied with.

Parent company corporate bodies are responsible, each to the extent of their own duties and prerogatives, for ensuring the suitable monitoring of compliance risk to which the Group is or could be exposed.

The Chief Compliance Officer, acting independently from operating structures and separately from the internal audit function, oversees monitoring of the non-compliance risk at a Group level. In particular, regulations on anti-money laundering, embargoes, armaments, anti-terrorism and anti-corruption are monitored by the Anti-Money Laundering Department, while for specific regulatory areas, the Chief Compliance Officer is assisted by other company structures with specific expertise such as the Antitrust Affairs and Strategic Support Sub-Department (for regulations on competition), the Safety and Protection Department (for aspects concerning privacy, environmental protection and occupational safety), and the Tax Sub-Department and Labour Policies Sub-Department. For all areas, the Internal Auditing Department controls the regular nature of operations and the adequacy and efficiency of monitoring, proposing any corrective actions required.

Intesa Sanpaolo has established organisational measures and procedures over time to prevent money laundering risk, and during the year a project was started to consolidate corruption risk management, leading to the approval of Guidelines on Anti-Corruption and the Identification of a Group Anti-Corruption Officer in March 2017.

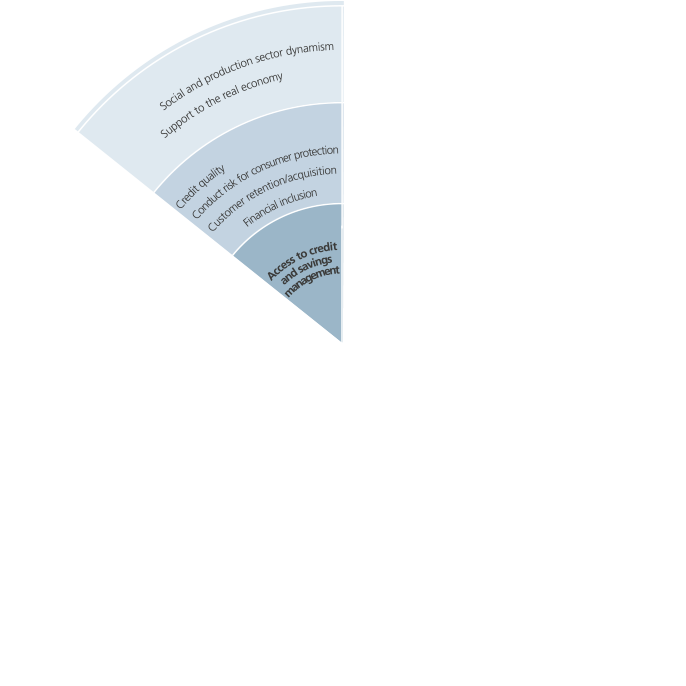

As for measures to protect customers “Group Guidelines for the management of claims, derecognition, appeals filed with the supervisory authorities and with alternative settlement bodies” were adopted to define the model and reference principles for evaluating and managing these cases at a Group level.

Internal regulations on tax compliance were issued to ensure that regulations are met in the development of products and services, structured operations and advisory activities as a whole. The Group continued to combat transactions in countries with little transparency and/or concerning particularly complex corporate structures with limited transparency in terms of ownership structures. In this framework, a tax function has been set up to control tax compliance processes and, along with other Tax Sub-Departments, specific documents on the Group's tax strategy are being formalised, as well as procedures for joining the “cooperation scheme” (a tax authority scheme to help taxpayers identify tax risks) with the financial authorities, to help promote relations based on cooperation, transparency and mutual trust.

Since the start of 2016, an internal reporting system (whistleblowing) has been in place for personnel to report actions or events that may constitute infringements of banking regulations.

The monitoring of the risk of compliance with competition protection rules has been further expanded and consolidated, to include EU regulations on state aid and Italian regulations supporting the competitiveness of the Italian system.

With regard to the protection of privacy, Intesa Sanpaolo ensures that personal data are collected and processed in accordance with legal provisions and principles in the Code of Ethics. All Group personnel receive training and updates on this issue, through mandatory and voluntary initiatives online, and in classroom sessions and activities focused on specific areas.

Performance indicators and objectives achieved

| Indicators | 2016 Results |

|---|---|

| Specialist training to prevent corruption and money laundering | 37,269 trained employees (42% of the total) 164,326 hours of training (4.2% of the total) |

| Whistleblowing | 22 reports, all followed up, of which 3 were identified as not relevant; specific investigations were started for the remaining 19 reports |